Moreover, it is essential to note that whereas these ideas could appear straightforward, their correct implementation requires experience and a spotlight to element. Due To This Fact, businesses should put money into skilled professionals or dependable accounting software program to hold up accurate and efficient monetary information. In distinction, the corporate’s trial stability has solely the ending steadiness present in these accounts of the corporate. If you don’t use a trial stability, you threat making ready monetary statements with potentially inaccurate knowledge.

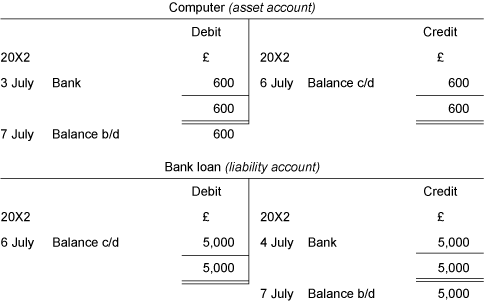

A great attribute of the general ledger is that it classifies transactions into numerous accounts. This makes it simple for businesses to verify and monitor their monetary operations. The whole closing balance of all ledger accounts for a sure time is shown in the trial balance. In a double-entry accounting system, every Debit is at all times matched by the same quantity of Credit.

With the help of both the general ledger and the trial balance, she’s capable of verify her financials before it’s too late. The Final Ledger and Trial Balance differ in objective and presentation. The Ledger is a comprehensive document of all monetary transactions, sorted into accounts. The Stability is a statement that checks the accuracy of the Ledger by comparing debits and credit.

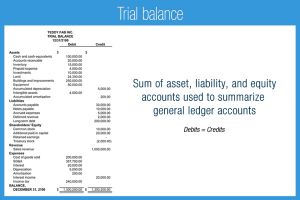

It lists the ending steadiness of each account in the general ledger, separated into debit and credit columns. The main purpose of the trial balance is to verify the mathematical accuracy of the overall ledger by making certain the total debits equal the total credits. By making certain that all debits and credit are equal, the trial steadiness helps make certain the accuracy of the data offered in these statements. This is crucial for sustaining credibility with stakeholders and traders.

Bar Cpa Follow Questions: Proprietary Funds Statement Of Cash Flows

- For that purpose, the final ledger is your best bet in terms of applying for business loans.

- The basic ledger is liable for recording and organizing all financial transactions, maintaining accurate monetary records, getting ready monetary statements, and helping with audits and tax returns.

- The Trial Stability is an announcement that lists all of the balances of the General Ledger accounts at a particular time limit.

- Both the overall ledger and trial stability play integral roles in a company’s monetary management, ensuring that each one transactions are recorded precisely and the ensuing financial statements are dependable.

- When wanting at the trial balance meaning, it’s useful to define what would go into all sides of the equation.

- A nice attribute of the general ledger is that it classifies transactions into various accounts.

Each account contains the transaction amounts that pertain to the account title. In distinction, a trial steadiness offers a abstract of the balances in every account with none additional details. It condenses the knowledge from the general ledger, making it simpler to review and detect errors without getting misplaced within the extensive details. Monetary reports depend on actual monetary data, not just guesstimates or forecasts.

How Solvexia Can Streamline Basic Ledger Processes

The trial balance helps to create different important reports, like earnings statements and stability sheets. It ensures that the information entered and the calculations are right, giving dependable financial info. By utilizing each instruments properly, entities ensure transparency and dependability in their accounting practices. The trial stability will tally if transactions are properly recorded using a double-entry accounting system. The trial balance is a summary of all account balances after all business transactions for a sure accounting period have been recorded. Auditors can evaluate the Trial Balance to supporting documentation, corresponding to invoices and bank statements, to make sure the accuracy and completeness of the recorded transactions.

If the trial stability doesn’t balance, it indicates an error within the common ledger. Common errors embody transposition errors, incorrect posting of quantities, or omissions. It’s crucial to research and proper these errors before making ready financial statements. These examples spotlight the importance of the final ledger in day-to-day accounting processes. Its correct and up-to-date upkeep is essential for making certain the monetary stability and success of businesses. By using the complete potential of the final ledger, companies can optimize their financial administration practices and make informed choices that drive long-term development.

The chart of accounts is a list of all of the general ledger vs trial balance accounts used to report transactions. The number of accounts within the chart of accounts could additionally be greater than the variety of accounts in the general ledger. It’s a press release that tallies all the debit and credit score accounts of a company at one cut-off date.

In contrast, the Trial Stability offers a snapshot of the monetary place at a particular moment, allowing companies to assess their current state of finances. Your accountant or monetary advisor makes use of the final ledger to analyze each of your accounts during an audit. Your common ledger exhibits your whole transactions, including all your debits and credit. Therefore, to keep away from errors in the trial steadiness, it is important to verify the accuracy of the overall ledger accounts. The financial data are then summarized and transferred or posted from the sub-ledger to the general ledger after debiting and crediting all accounts to guarantee that https://www.quickbooks-payroll.org/ they steadiness. Posting to the final ledger is often accomplished at the end of a reporting interval (e.g., monthly, or annually).

The trial balance is a report run on the finish of an accounting period, listing the ending stability in every general ledger account. The preliminary trial balance that’s run on the finish of an accounting interval known as the unadjusted trial steadiness. If the total debits and credits do not match, it signifies that there is an error within the recording of transactions. This discrepancy could be due to various reasons, such as incorrect postings, mathematical errors, or lacking entries. By figuring out these errors, the Trial Steadiness permits businesses to rectify them earlier than making ready monetary statements. A trial balance is an inventory of the account names and their balances from the overall ledger.